GoDaddy buys 30 new gTLDs for over $120 million

GoDaddy Registry has just announced it is acquiring 28 new gTLDs from rival MMX, along with the TLDs .club and .design.

The MMX deal is worth at least $120 million; the value of the other two deals was not disclosed.

GoDaddy is also taking over the back-ends for .rugby and .basketball, which had been contracted to MMX, and said it has won the back-end deal for the dot-brand, .ally.

It’s the most significant pieces of registry consolidation since Donuts and Afilias hooked up in December.

GoDaddy Registry will wind up being the contract holder or back-end for over 240 TLDs, with over 14 million domains under management, the company said.

It’s not entirely clear which gTLDs GoDaddy is acquiring right now, but it appears to be all of those listed on the MMX web site.

It’s currently listed by IANA as the sponsor for 21 gTLDs: .cooking, .fishing, .horse, .miami, .rodeo, .vodka, .beer, .luxe, .surf, .nrw, .work, .budapest, .casa, .abogado, .wedding, .yoga, .fashion, .garden, .fit, .vip and .dds.

MMX subsidiary ICM Registry runs .xxx, .porn, .adult and .sex, not an easy fit with the family-friendly image GoDaddy has attempted to cultivate in recent years.

MMX also manages geographic gTLDs .boston, .london and .bayern on behalf of their respective local governments.

The company hinted in January that it was considering selling off some of its under-performing registries, after a crappy 2020 that saw it forced to restate revenues, lay off staff and can its top executives.

MMX, which is publicly traded in London, has yet to make a statement on the deal but we should no doubt expect something in the morning before the markets open.

The deal appears to be bad news for Nominet, which runs the back-end for most MMX gTLDs. GoDaddy will very likely migrate them over to its own platform eventually.

MMX aside, GoDaddy is also buying .club from .CLUB Domains, according to its press release.

.CLUB is a bit of a rarity — a single-string new gTLD registry that done really rather well for itself without tarnishing its brand by becoming synonymous with cheap domains and spam.

.design, the other GoDaddy acquisition today, is run by Top Level Design, which also runs .ink, .wiki and .gay.

.design has over 120,000 domains in its zone file today, while .club has over 1 million. Both have been on a growth trajectory recently.

GoDaddy also said as part of the same announcement that it has signed Ally Financial’s dot-brand business for .ally, but as Ally was already a client of Neustar (which GoDaddy owns) I’m not entirely sure what it’s getting excited about.

One.com takes big chunk of Danish market with third acquisition this year

European registrar One.com says it is now the biggest player in the Danish market after acquiring rival Larsen Data, which does business as GratisDNS, for an undisclosed sum.

One.com says that the deal means it now sponsors over 400,000 of the 1.3 million extant .dk domains, making it the largest local registrar.

GratisDNS has been around since 2001. It’s not a big player in gTLDs, with only 550 names under management at the last count.

It’s the third announced acquisition by One.com this year. It also bought Dutch hosting provider Hostnet and Norwegian registrar SYSE.

The company also recently said that, like so many other registrars, business has been booming during the coronavirus pandemic as bricks-and-mortar businesses relocate online.

Interestingly, sales were up 55% year-on-year in locked-down Denmark, but only up 7% in quarantine-free Sweden.

One.com also runs the .one gTLD, which has almost 78,000 names in its zone file right now. The registrar has been offering first-year regs for free recently.

GratisDNS had planned to apply for a city gTLD for Copenhagen back in 2012, but failed to secure governmental interest.

Web.com acquires another of the original five registrars

Consolidation in the domain industry continues apace, with Web.com bringing one of the remaining original five competitive registrars into its stable for AUD 12.2 million ($8.3 million) in cash.

It’s acquiring an Australian company called Webcentral Group, which until last month was known as ARQ Group and before that as Melbourne IT.

Webcentral also runs the retail registrars Netregistry and, in New Zealand, Domainz. It has about 330,000 customers, though not all are registrants.

Web.com says the deal gives it a deeper footprint in the Aussie, Kiwi and Southeast Asian markets.

My records show that Webcentral had about 130,000 domains under management at the end of March on its Melbourne IT tag, down by about 6,000 year over year. That’s not counting regs in ccTLDs such as .au.

Netregistry had another 113,000 gTLD domains, down from 129,000 a year earlier.

After the deal closes, Web.com will own the three oldest active registrars as measured by IANA ID — Network Solutions, Register.com and now Melbourne IT. The latter two were among the first five to go live after ICANN introduced competition at the registrar level in 1999.

For Webcentral, the deal marks the conclusion of a three-stage sell-off that started over a year ago when it sold its TPP Wholesale business to UK consolidator CentralNic.

Then, this February, it announced the sale of its enterprise unit to private equity for AUD 36 million ($25 million). It had been publicly looking for a buyer for its remaining SMB registrar business for many months.

The root cause of the sell-offs appears to be the company’s crippling debt.

Webcentral had expected to be hit unfavorably by the coronavirus pandemic, but that was largely due to its exposure to the digital marketing market, via its WME brand, rather than dwindling domain sales.

GoDaddy blamed the same problem for its recently announced layoffs.

Webcentral is currently listed on the Australian Stock Exchange. Web.com itself fell into private equity hands in a $2 billion deal in 2018.

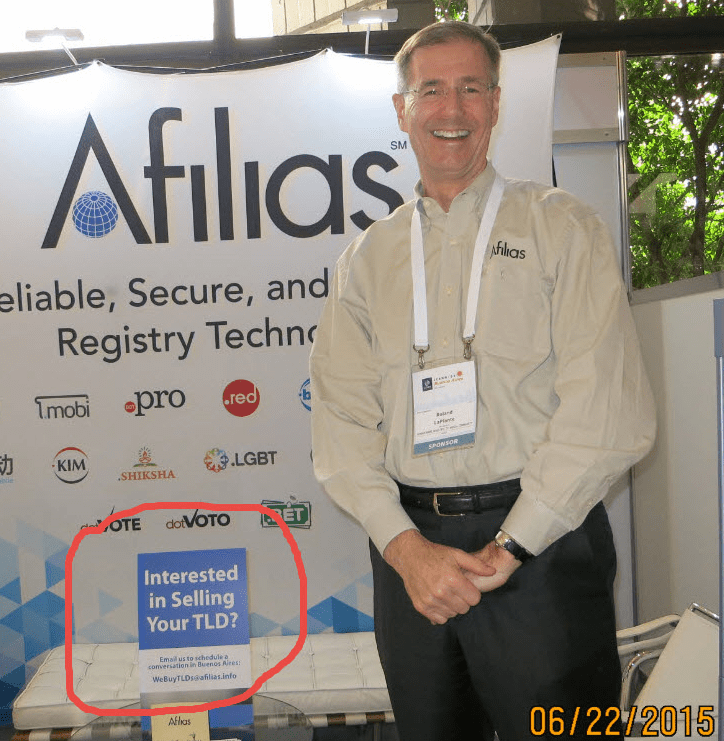

Afilias wants to buy your failed gTLD

Afilias is on an overt campaign to snap up struggling new gTLDs at bargain basement prices.

“In the neighborhood of a dozen” gTLD operators responded seriously to Afilias’ booth at last month’s ICANN meeting in Buenos Aries, (pictured), Afilias chief marketing officer Roland LaPlante told DI in an interview today.

The company could potentially buy up tens of gTLDs over the coming year, LaPlante said.

“If all of these 500 strings with less than 5,000 names in them start looking for a new owner, it’s going to be a pretty active marketplace,” he said.

“There are entrants in the market who either have found the market is not as they expected, or results are not what they need, or for whatever other reason they’re coming to the conclusion this isn’t the business they should be in and they’re looking for options,” LaPlante said.

“There’s been a cold splash of water in the face for a lot of people who didn’t expect it, they’re struggling with relatively low revenues compared to what they might have expected,” he said. “They’re likely to be looking for options.”

Afilias would be happy to take these contracts off their current owners’ hands, for the right price.

“Frankly, we’re not going to be paying huge prices for them,” LaPlante.

“We’ve run into a number of folks who still have fairly inflated opinions of what their string is worth,” he said. “Some of these strings are attractive, but they’re going to need a lot more time to mature.”

Afilias believes that the economies of scale it already has in place would enable it to turn a profit at a much lower registration volume, perhaps under 50,000 names, and that it has the patience and financial strength to wait for its acquisitions to hit those volumes.

“We’re very conservative in our volume estimates,” LaPlante said.

Afilias currently has 26 new gTLDs as back-end and 13 as contracted registry operator.

The company is basically looking for acquisitions where the seller’s looming alternative might be the Emergency Back-End Registry Operator, and where the fees associated with an auction might be a bit too rich.

While LaPlante jokingly compared the proposition to the “We Buy Any Car” business model, he admitted that some registries are less attractive than others.

gTLDs with a lot of restrictions or monitoring would be treated with much more caution — Afilias was not interested in .hiv, which failed to sell at auction recently, for example — and would be skeptical about registries that have given away large numbers of free domains.

“We’d like to pick up strings that have good potential for a profitable amount of volume,” he said.

Afilias quietly sold .meet to Google earlier this year, but LaPlante denied that Afilias is in the business of flipping gTLDs. While he could not get into details, he said the .meet deal was a “special case”.

As we discovered last week, at least eight new gTLDs have changed ownership since signing their registry contracts. A few others have been acquired pre-contracting.

Recent Comments