Afilias wants to buy your failed gTLD

Afilias is on an overt campaign to snap up struggling new gTLDs at bargain basement prices.

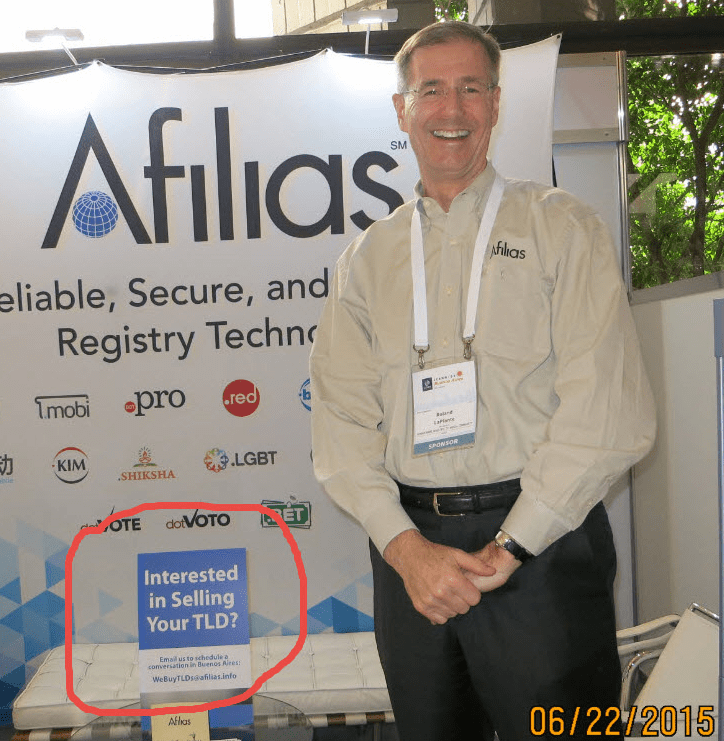

“In the neighborhood of a dozen” gTLD operators responded seriously to Afilias’ booth at last month’s ICANN meeting in Buenos Aries, (pictured), Afilias chief marketing officer Roland LaPlante told DI in an interview today.

The company could potentially buy up tens of gTLDs over the coming year, LaPlante said.

“If all of these 500 strings with less than 5,000 names in them start looking for a new owner, it’s going to be a pretty active marketplace,” he said.

“There are entrants in the market who either have found the market is not as they expected, or results are not what they need, or for whatever other reason they’re coming to the conclusion this isn’t the business they should be in and they’re looking for options,” LaPlante said.

“There’s been a cold splash of water in the face for a lot of people who didn’t expect it, they’re struggling with relatively low revenues compared to what they might have expected,” he said. “They’re likely to be looking for options.”

Afilias would be happy to take these contracts off their current owners’ hands, for the right price.

“Frankly, we’re not going to be paying huge prices for them,” LaPlante.

“We’ve run into a number of folks who still have fairly inflated opinions of what their string is worth,” he said. “Some of these strings are attractive, but they’re going to need a lot more time to mature.”

Afilias believes that the economies of scale it already has in place would enable it to turn a profit at a much lower registration volume, perhaps under 50,000 names, and that it has the patience and financial strength to wait for its acquisitions to hit those volumes.

“We’re very conservative in our volume estimates,” LaPlante said.

Afilias currently has 26 new gTLDs as back-end and 13 as contracted registry operator.

The company is basically looking for acquisitions where the seller’s looming alternative might be the Emergency Back-End Registry Operator, and where the fees associated with an auction might be a bit too rich.

While LaPlante jokingly compared the proposition to the “We Buy Any Car” business model, he admitted that some registries are less attractive than others.

gTLDs with a lot of restrictions or monitoring would be treated with much more caution — Afilias was not interested in .hiv, which failed to sell at auction recently, for example — and would be skeptical about registries that have given away large numbers of free domains.

“We’d like to pick up strings that have good potential for a profitable amount of volume,” he said.

Afilias quietly sold .meet to Google earlier this year, but LaPlante denied that Afilias is in the business of flipping gTLDs. While he could not get into details, he said the .meet deal was a “special case”.

As we discovered last week, at least eight new gTLDs have changed ownership since signing their registry contracts. A few others have been acquired pre-contracting.

Afilias isn’t alone!

We’ll buy your back end service provider!

ARI is interested in buying Afilias?

Actually, I thought some company from India would buy ARI as it’s now based there: https://www.ariservices.com/news-ARI%20opens%20new%20office%20in%20India%20to%20cut%20costs.php