As .wed goes EBERO, did the first new gTLD just fail?

A wedding-themed gTLD with a Bizarro World business model may become the first commercial gTLD to outright fail.

.wed, run by a small US outfit named Atgron, has become the first non-brand gTLD to be placed under ICANN’s emergency control, after it lost its back-end provider.

DI understands that Atgron’s arrangement with its small New Zealand back-end registry services provider CoCCA expired at the end of November and that there was a “controlled” transition to ICANN’s Emergency Back-End Registry Operator program.

The TLD is now being managed by Nominet, one of ICANN’s approved EBERO providers.

It’s the first commercial gTLD to go to EBERO, which is considered a platform of last resort for failing gTLDs.

A couple of unused dot-brands have previously switched to EBERO, but they were single-registrant spaces with no active domains.

.wed, by contrast, had about 40 domains under management at the last count, some apparently belonging to actual third-party registrants.

Under the standard new gTLD Registry Agreement, ICANN can put a TLD in the emergency program if they fail to meet up-time targets in any of five critical registry functions.

In this case, ICANN said that Atgron had failed to provide Whois services as required by contract. The threshold for Whois triggering EBERO is 24 hours downtime over a week.

ICANN said:

Registry operator, Atgron, Inc., which operates gTLD .WED, experienced a Registration Data Directory Services failure, and ICANN designated EBERO provider Nominet as emergency interim registry operator. Nominet has now stepped in and is restoring service for the TLD.

The EBERO program is designed to be activated should a registry operator require assistance to sustain critical registry functions for a period of time. The primary concern of the EBERO program is to protect registrants by ensuring that the five critical registry functions are available. ICANN’s goal is to have the emergency event resolved as soon as possible.

However, the situation looks to me a lot more like a business failure than a technical failure.

Multiple sources with knowledge of the transition tell me that the Whois was turned off deliberately, purely to provide a triggering event for the EBERO failover system, after Atgron’s back-end contract with CoCCA expired.

The logic was that turning off Whois would be far less disruptive for registrants and internet users than losing DNS resolution, DNSSEC, data escrow or EPP.

ICANN was aware of the situation and it all happened in a coordinated fashion. ICANN told DI:

WED’s backend registry operator recently notified ICANN that they would likely cease to provide backend registry services for .WED and provided us with the time and date that this would occur. As such, we were aware of the pending failure worked to minimize impact to registrants and end users during the transition to the Emergency Back-end Registry Operator (EBERO) service provider.

In its first statement, ICANN said that Nominet has only been appointed as the “interim” registry, while Atgron works on its issues.

It’s quite possible that the registry will bounce back and sign a deal with a new back-end provider, or build its own infrastructure.

KSregistry, part of the KeyDrive group, briefly provided services to .wed last week before the EBERO took over, but I gather that no permanent deal has been signed.

One wonders whether it’s worth Atgron’s effort to carry on with the .wed project, which clearly isn’t working out.

The company was founded by an American defense contractor with no previous experience of the domain name industry after she read a newspaper article about the new gTLD program, and has a business model that has so far failed to attract customers.

The key thing keeping registrars and registrants away in droves has been its policy that domains could be registered (for about $50 a year) for a maximum period of two years before a $30,000 renewal fee kicked in.

That wasn’t an attempt to rip anybody off, however, it was an attempt to incentivize registrants to allow their domains to expire and be used by other people, pretty much the antithesis of standard industry practice (and arguably long-term business success).

That’s one among many contractual reasons that only one registrar ever signed up to sell .wed domains.

Atgron’s domains under management peaked at a bit over 300 in March 2016 and were down to 42 in August this year, making it probably the failiest commercial new gTLD from the 2012 round.

In short, .wed isn’t dead, but it certainly appears extremely unwell.

UPDATE: This post was updated December 12 with a statement from ICANN.

Numeric .xyz names plummet despite dollar deal

XYZ.com’s effort to sell over a billion numeric .xyz domains at just $0.65 each does not appear to be gaining traction.

The number of qualifying domains in the .xyz zone file has plummeted by almost 200,000 since the deal was introduced and dipped by over 4,000 since the blanket discount went live.

The $0.65 registry fee applies to what XYZ calls the “1.111B Class” of domains — all 1.111 billion possible six, seven, eight and nine-digit numeric .xyz domains.

These domains carry a recommended retail price of $0.99.

It’s not a promotional price. It’s permanent and also applies to renewals.

Some registrars opted to start offering the lower price from June 1, but it did not come into effect automatically for all .xyz registrars until November 11

The number of domains in this class seems to be on a downward trend, regardless.

There were 272,589 such domains May 31, according to my analysis of .xyz zone files, but that was down to 74,864 on December 5.

On November 10, the day before the pricing became uniform, there were 78,256 such domains. That shows a decline of over 4,000 domains over the last four weeks.

It’s possible that the 1.111B offer is attracting registrants, but that their positive impact on the numbers is being drowned out by unrelated negative factors.

The period of the 200,000-name decline coincides with the massive mid-July junk drop, in which .xyz lost over half of its total active domains due to the expiration of domains registered for just a penny or two in mid-2015.

Many of those penny domains were numeric, due to interest from speculators from China, where such names have currency.

The period also coincides with a time in which XYZ was prohibited from selling via Chinese registrars, due to a problem changing its Real Names Verification provider.

In recent marketing, XYZ has highlighted some interesting uses of 1.111B domains, including a partnership with blockchain cryptocurrency Ethereum.

Other registrants are using the domains to match important dates and autonomous system numbers.

DotKids doesn’t want .kids auction to go ahead

One of the applicants for the .kids gTLD has asked ICANN to stop the planned last-resort auction.

DotKids Foundation is competing with Amazon for .kids and, because the two strings were ruled confusingly similar, with Google’s application for the singular .kid.

ICANN last month set a January 25 date for the three contenders to go to auction, having unfrozen DotKids’ application back in October.

DotKids’ bid had been put on hold due to it losing a Community Priority Evaluation — which found overwhelmingly that the organization did not represent a proper community — and its subsequent appeals of that ruling.

But the foundation now says that its application should be treated the same as .music, .gay, and a few others, which are currently on hold while ICANN waits for the results of a third-party review of the CPE process.

DotKids filed a Request for Reconsideration (pdf) with ICANN yesterday, immediately after being told that there were no plans to put the contention set back on hold.

Tomorrow is the deadline for the three applicants to submit their information to ICANN to participate in next month’s auction.

An ICANN last-resort auction sees the winning bid being placed in a fund for a yet-to-be-determined purpose, as opposed to private auctions where the losing bidders share the loot.

China and cheapo TLDs drag down industry growth — CENTR

The growth of the worldwide domain industry continued to slow in the third quarter, according to data out today from CENTR.

There were 311.1 million registered domains across over 1,500 TLDs at the end of September, according to the report, 0.7% year-over-year growth.

The new gTLD segment, which experienced a 7.2% decline to 20.6 million names, was the biggest drag.

The new gTLD segment, which experienced a 7.2% decline to 20.6 million names, was the biggest drag.

But that decline is largely due to just two high-volume, low-price gTLDs — .xyz and .top — which lost millions of names that had been registered for pennies apiece.

Excluding these TLDs, year-over-year growth for the whole industry would have been 2.5%, CENTR said. The report states:

Over the past 2 years, quarterly growth rates have been decreasing since peaks in early 2016. The slowdown is the result of deletes after a period of increased investment from Chinese registrants. Other explanations to the slowdown are specific TLDs, such as .xyz and .top, which have contracted significantly.

The legacy gTLDs inched up by 0.2%, largely driven by almost two million net new names in .com. In fact, only five of the 17 legacy gTLDs experienced any growth at all, CENTR said.

In the world of European ccTLDs, the average (median) growth rate has been flat, but CENTR says it sees signs of a turnaround.

CENTR is the Council of European National Top-Level Domain Registries. Its Q3 report can be downloaded here (pdf).

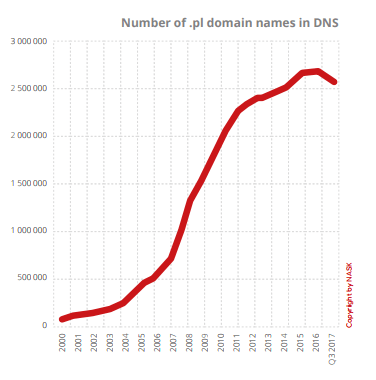

New gTLDs blamed as .pl starts to shrink

Polish ccTLD .pl has lost over 125,000 domains in the last year, a change of growth trajectory blamed partly on new gTLDs.

NASK, the registry, released its third-quarter report in English today. It’s overflowing with more statistics than you could possibly need about the TLD’s performance.

The headline is that .pl is on the decline. On NASK’s web site, it reports registrations as of today are down 128,671 on the last 12 months.

It has 2,577,566 active domains in total today, 2,592,014 at the end of September, about three quarters of which are direct second-level registrations.

It has 2,577,566 active domains in total today, 2,592,014 at the end of September, about three quarters of which are direct second-level registrations.

It’s one of many ccTLDs to have started to feel the pinch over the last few years. Increased competition, spurred by the expansion of the gTLD space, has been fingered as a likely culprit.

In the report’s introduction, NASK director Wojciech Kamieniecki wrote:

Temporary slowdown of the dynamics of the .pl domain market, observed from the beginning of the year — decrease in the number of new registrations — should be perceived in the light of extending the selection of attractive names as well as a growing number of new generic domains and increase in competition in the global domain market.

The renewal rate overall was 62.22%, a slight increase on 2016 but still on the low side for an established TLD. However, if you exclude third-level registrations (under .com.pl and .net.pl for example) the rate was a much more respectable 76.37%.

There were 203,898 new domains registered in the third quarter.

The vast majority — 93.96% — of current .pl domains are registered to Polish registrants, with registrants from Germany, the UK and the US also contributing to the total.

The full Q3 report can be downloaded here (pdf).

Radix claims 77% renewal rates after two years

New gTLD registry Radix says that three of its larger TLDs have seen a 77% renewal rate two years after launch.

The company said today that .online had 75% renewals, with .tech at 78% and .site at 81%.

It appears to have carved out these three from its portfolio for attention, ignoring the rest of its portfolio, because they all went to general availability in the same two-month period July and August 2015.

The renewal rates are for the first month of GA. In other words, 77% of the domains registered in the TLDs’ respective first month have been renewed for a third year.

Radix, in a press release, compared the numbers favorably to .com and .net, which had a combined renewal rate of 74% in the second quarter according to Verisign’s published numbers.

It’s probably not a fully fair apples-to-apples comparison. Domains registered in the first month of GA are likely higher-quality names registered by in-the-know early adopters, and therefore less likely to be dropped, whereas .com and .net have decades of renewal cycles behind them.

Radix also said that 86% of domains registered during the three TLDs’ sunrise periods and Early Access Periods are still being renewed, with .tech at 92% and .site at 88%.

Amazon and Google to fight over .kids at auction

Amazon, Google and a third applicant are scheduled to fight for control of the new gTLDs .kid or .kids at auction.

It’s the first ICANN gTLD auction to be scheduled since a Verisign puppet paid $135 million for .web in July 2016.

According to ICANN documentation, .kid and .kids will go to auction January 25, 2018.

The winning bid will be added to ICANN’s quarter-billion-dollar stash of auction proceeds, rather than shared out between the applicants.

Even though two different strings are at stake, it will be a so-called “direct contention” auction, meaning only .kids or .kid will ultimately go live.

Google, the sole applicant for .kid, had filed String Confusion Objections against .kids applications from Amazon and DotKids Foundation and won both, meaning the three applications were lumped into the same contention set.

Unless DotKids has a secret sugar daddy, it seems probable that the internet will next year either get a .kid gTLD operated by Google or a .kids gTLD operated by Amazon.

DotKids had applied as a “community” application and attempted to shut out both rivals and avoid an auction by requesting a Community Priority Evaluation.

However, it comprehensively lost the CPE.

Child-friendly domain spaces have a poor track record, partly due to the extra restrictions registrants must agree to, and are unlikely to be high-volume gTLDS no matter who wins.

Neustar operated .kids.us for 10 years, following US legislation, but turned it off in 2012 after fewer than 100 web sites used the domain. It made the decision not to reintroduce it in 2015.

The Russian-language equivalent, .дети, has been live for over three years but has only around 1,000 domains in its zone file.

The .kids/.kid auction may not go ahead if the three applicants privately negotiate a deal soon, but they’ve had over a year to do so already and have apparently failed to come to an agreement.

59,000% revenue growth at Donuts leads to Deloitte award

Deloitte has placed new gTLD registry Donuts at the top of its 2017 Technology Fast 500, a league table of the fastest-growing North American technology firms.

Donuts won by growing its revenue by 59,093% over three years.

Given that Donuts didn’t have its first revenue-generating gTLD delegated until the final quarter of 2013, the three-year judging period basically covers almost the entire period of its existence as a trading company.

The runners up were ClassPass (46,556%, founded 2013), which gives fitness junkies a centralized way to book from multiple classes, and Toast (31,250%, founded 2012), which makes point-of-sale software for restaurants.

Companies could submit themselves for consideration on the 500-strong table. They only needed 135% growth over three years to make it to the list.

The rankings are based on revenue, not profit, so it does not necessarily mean that gTLDs are a way to get rich quick.

Still, it’s impressive that something as dated as domain names could top the rankings, given the number of transformational technologies hitting the market every year.

“We own your name” government tells Amazon in explosive slapdown

Amazon suffered a blistering attack from South American governments over its controversial .amazon gTLD applications this weekend.

A Peruvian official today excoriated Amazon’s latest peace offering, telling the tech giant in no uncertain terms that the word “Amazon” is not its property and demanding an apology for the company’s alleged behavior during recent legal proceedings.

“We will be giving you permission to use a certain word, not the other way around,” she said. “We are the owners of the Amazonian region.”

Speaking for almost 10 minutes during a session at the ICANN 60 meeting in Abu Dhabi this afternoon, Peru’s representative to the Governmental Advisory Committee pulled rank and scolded Amazon like a naughty schoolchild.

She claimed that Amazon had been bad-mouthing Peru by saying former GAC reps had “lied to and manipulated” the rest of the GAC in order to get support for its objection. She then demanded an apology from the company for this.

She was speaking in support of the idea that the string “Amazon” belongs to the people of the Amazonas region, which covers as many as eight South American countries, rather than the American company, despite the fact that none of those countries use the English word to describe the region.

Her remarks drew applause from parts of the audience.

Amazon had showed up at the session — described by two GAC reps later as a “lion’s den” — to offer a “strong, agreed-upon compromise that addresses the needs of the governments”.

The proposed deal would see the GAC drop its objections to .amazon in exchange for certain safeguards.

Amazon is promising to reserve geographically and culturally sensitive words at the second level in .amazon.

The domain rainforest.amazon, its associate general counsel Dana Northcott said by way of example, would be never be used by anyone.

Affected governments would get to negotiate a list of such terms before .amazon went live and there’d be an ongoing consultation process for more such terms to be protected in future.

The company has also promised not to object to — and in fact to actively support with hard resources — any future applications for .amazonas or other local-language variants by the people of the region.

But Peru was not impressed, telling the company that not only is the English version of the name of the region not its property but also that it must show more respect to governments.

“No government is going to accept any impositions from you,” she said, before appealing to fellow GAC members that the issue represents a kind of existential threat.

“The core issue here… is our survival as governments in this pseudo-multi-stakeholder space that has been invented,” she said.

“They want us to believe this is a place where we have dignity but that is increasingly obvious that this is not the case,” she said. “We don’t have it. And that is because of companies like yours… Companies that persist in not respecting the governments and the people they represent.”

The Peruvian GAC rep, listed on the GAC web site as María Milagros Castañon Seoane but addressed only as “Peru” during the session, spoke in Spanish; I’ve been quoting the live interpretation provided by ICANN.

Her remarks, in my opinion, were at least partially an attempt to strengthen her side’s negotiating hand after an Independent Review Process panel this July spanked ICANN for giving too much deference to GAC advice.

The IRP panel decided that ICANN had killed the .amazon applications — in breach of its bylaws — due to a GAC objection that appeared on the face of the public record to be based on little more than governmental whim.

The panel essentially highlighted a clash between ICANN’s bylaws commitments to fairness and transparency and the fact that its New gTLD Applicant Guidebook rules gave the GAC a veto over any application for any reason with no obligation to explain itself.

It told ICANN to reopen the applications for consideration and “make an objective and independent judgment regarding whether there are, in fact, well-founded, merits-based public policy reasons for denying Amazon’s applications”.

That was back in July. Earlier today, the ICANN board of directors in response to the IRP passed a resolution calling for the GAC to explain itself before ICANN 61 in March next year, resolving in part:

Resolved (2017.10.29.02), the Board asks the GAC if it has: (i) any information to provide to the Board as it relates to the “merits-based public policy reasons,” regarding the GAC’s advice that the Amazon applications should not proceed; or (ii) any other new or additional information to provide to the Board regarding the GAC’s advice that the Amazon applications should not proceed.

Other governments speaking today expressed doubt about whether the IRP ruling should have any jurisdiction over such GAC advice.

“It is not for any panelist to decided what is public policy, it is for the governments to decide,” Iran’s Kavouss Arasteh said.

During a later session today the GAC, talking among itself, made little progress in deciding how to formally respond to the ICANN board’s resolution.

A session between the GAC and the ICANN board on Tuesday is expected to be the next time the issue raises its increasingly ugly head.

This is who won the .inc, .llc and .llp gTLD auctions

The winners of the auctions to run the gTLD registries for company identifiers .inc, .llc and .llp have emerged due to ICANN application withdrawals.

All three contested gTLDs had been held up for years by appeals to ICANN by Dot Registry — an applicant with the support of US states attorneys general — but went to private auction in September after the company gave up its protests for reasons its CEO doesn’t so far want to talk about.

The only auction won by Dot Registry was .llp. That stands for Limited Liability Partnership, a legal construct most often used by law firms in the US and probably the least frequently used company identifier of the three.

Google was the applicant with the most cash in all three auctions, but it declined to win any of them.

.inc seems to have been won by a Hong Kong company called GTLD Limited, run by DotAsia CEO Edmon Chong. DotAsia runs .asia, the gTLD granted by ICANN in the 2003 application round.

My understanding is that the winning bid for .inc was over $15 million.

If that’s correct, my guess is that the quickest, easiest way to make that kind of money back would be to build a business model around defensive registrations at high prices, along the lines of .sucks or .feedback.

My feedback would be that that business model would suck, so I hope I’m wrong.

There were 11 original applicants for .inc, but two companies withdrew their applications years ago.

Dot Registry, Uniregisty, Afilias, GMO, MMX, Nu Dot Co, Google and Donuts stuck around for the auction but have all now withdrawn their applications, meaning they all likely shared in the lovely big prize fund.

MMX gained $2.4 million by losing the .inc and .llc auctions, according to a recent disclosure.

.llc, a US company nomenclature with more potential customers of lower net worth, went to Afilias.

Dot Registry, MMX, Donuts, LLC Registry, Top Level Design, myLLC and Google were also in the .llc auction and have since withdrawn their applications.

Recent Comments